13/03/2014

The hybrid-electric vehicle (HEV) sector, which relates to vehicles having both a conventional engine and an electric motor for motive power, is a key area for many carmakers battling to meet strict efficiency and emissions regulations, as it enables fuel consumption and CO2 emissions to be decreased. This field is distinct from the electric vehicle (EV) sector, which relates to vehicles driven purely by electric motors.

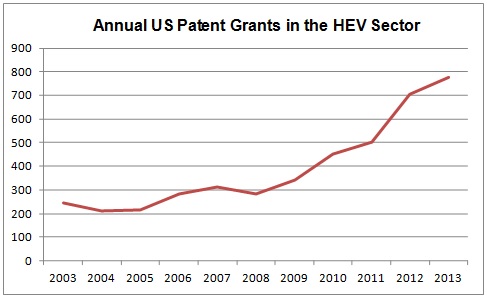

As reported in our earlier blog post, the Clean Energy Patent Growth Index (CEPGI) for the third quarter of 2013 was recently published by US law firm Heslin Rothenberg. Among other trends, the most recent CEPGI indicates an acceleration of the upward trend in US patent grants for HEV and EV technologies over the past five years, as shown here.

The original plan for this report had been to study the trend indicated by the CEPGI in more detail and examine possible reasons for the sharp increase and the degree to which the trend is driven by the HEV sector as opposed to the EV sector. However, the data behind the CEPGI report are not available, making such analysis difficult.

The solution? We formulated our own index1. By searching for US patents according to the classifications applied to them by patent office examiners, we created a database of US patents granted for HEV technologies from 2003 to 2013. Since the US is the largest global market for HEVs, the granting of patents by the US Patent and Trademark Office (USPTO) can be taken as an indicator of global HEV innovation.

Although the exact numbers resulting from our search differ from those of the CEPGI, the overall trend is broadly the same, as seen below:

As can be seen, in the period from 2003 to 2008, the trend was slightly upward, with an increase of 16% in the number of HEV patents granted in 2008 (283 in total) compared to 2003 (244 in total). However, the number of HEV patents granted each year has increased significantly since 2008. By last year, the figure stood at 778; almost three times the number granted in 2008. So, what could be behind the increase?

Looking at the ownership of HEV patents, it can be seen that the number of companies obtaining granted HEV patents more than doubled between 2008 and 2013; while HEV patents were granted to 70 patentees in 2008, this number had increased to 150 patentees by 2013. Included among the patentees in 2013 were new players in the auto industry, such as Fisker Automotive and Elon Musk’s Tesla, as well as a number of “outsiders” from other fields who have now started to develop and patent HEV technologies.

Another interesting finding is that the number of HEV patents granted to traditional carmakers and their suppliers has rocketed since 2008, despite the fact that many of these companies have been active in the HEV market for quite some time. Leading the way with HEV patents in 2013 are:

- Toyota – 146 patents (up from 39 in 2008)

- GM – 106 patents (up from 31 in 2008)

- Ford – 50 patents (up from 26 in 2008)

- Aisin – 33 patents (up from 10 in 2008)

- Bosch – 33 patents (up from 4 in 2008)

- ZF – 31 patents (up from 5 in 2008)

- Honda – 30 patents (up from 9 in 2008)

- Hyundai – 23 patents (up from 6 in 2008)

So, not only has there been a large increase in the number of patentees in HEV technology, the number of patents obtained by traditional auto companies has also surged upward.

The latter could well be explained, at least in part, by the former. As a particular patent landscape becomes more densely populated, the risk of infringement and litigation also increases, particularly as innovative technologies are commercialised. The increased risk of litigation applies to the auto industry as a whole, with technology giants Google, Apple and Microsoft also looking to expand their activities (and presumably their rivalries) into cars. Indeed, there are parallels to be drawn between the auto industry and the smartphone industry, where established manufacturers and newcomers alike have been embroiled in IP litigation for several years. Carmakers could do worse than to avoid the same outcome, not only due to the financial cost of litigation and the required diversion of resources but also due to the potential for reputational damage. This could be particularly apparent in the HEV sector, where carmakers are faced with a host of unfamiliar new competitors and suppliers, some of whom may be far more aggressive when it comes to patent enforcement. Judging by our findings, it seems that carmakers have responded to the threat with action.

By increasing the size of their patent portfolios, carmakers and their suppliers are better able to protect their HEV technologies against infringement. Crucially, large patent portfolios can also hinder the activities of competitors and deter them from enforcing their own patent rights for fear of inviting multiple counterclaims for infringement. At the risk of rehashing Sun Tzu with fists of ham, it seems that for carmakers, the best form of defence is (to instil in others the fear of) attack. It remains to be seen whether this strategy will be successful.

As a footnote, despite the boom in granted patents in recent years, our search indicates that the number of patent applications for HEV technologies has in fact decreased sharply since the economic downturn hit in 2008/2009, with the number of HEV applications filed in 2011 apparently down 40% from the number filed in 2008. I say “apparently”, since the HEV tag is not necessarily assigned to all applications prior to their grant and, therefore, might not provide a complete picture of pending applications. However, although the figure for applications might not be definitive, it is certainly indicative that patenting activity in the HEV sector has dropped somewhat since 2008. Given the average time from filing to grant for US patents is in the region of 4 years, if our figures for applications are correct, the upward trend in HEV patents may well soon be seen to have come to an end. At least for now.

- Source: LexisNexis, TotalPatent®

This article is for general information only. Its content is not a statement of the law on any subject and does not constitute advice. Please contact Reddie & Grose LLP for advice before taking before any action in reliance on it.