28/05/2020

For most people, the term “flying taxi” may conjure up images of Milla Jovovich crashing into Bruce Willis’s taxi in “The Fifth Element” in the year 2263 rather than feats of present-day engineering. However, a slew of long-established industrial giants, like Toyota, Boeing, and Airbus, newer tech giants, like Uber, Google, or Amazon, and disruptive start-ups of which there are too many to list, are doing their best to bring flying taxis from 23rd century science-fiction to present day reality.

So called electric vertical take-off and landing (eVTOL) aircraft, like helicopters, are capable of taking-off and landing vertically – essential for flight in dense urban environments. However, unlike helicopters, eVTOLs rely exclusively on electric propulsion, and are almost exclusively pilotless, making them the most promising contenders for the development of “flying taxis”.

So, why can’t you ride-hail flying taxis yet?

Amongst the established companies trying to make flying taxis work is Toyota, who as far back as 2014 filed patents reminiscent more of Back To The Future: Part II than present-day taxis.

In 2017, the Japanese carmaker expressed a desire to have a “flying car” light the Olympic flame at the opening ceremony of the 2020 Olympics in Tokyo. Although that target was put off by at least one year by the coronavirus crisis, and the 2020 Olympics became the 2021 Olympics, the ambitions of established automotive companies, tech giants, and start-ups remain sky-high.

The main selling point for flying taxis seems obvious: flying taxis do not get stuck in traffic and, as a side effect, fewer cars on the road mean fewer traffic jams for everyone. However, the regulatory and technological barriers that will have to be overcome are plentiful and challenging. Three of the main challenges for developers of eVTOLs are range, safety, and noise.

As the range of eVTOLs is mainly dictated by the energy of Li-ion batteries, which are preferred by most manufacturers, any major development in this area is most likely to come from novel batteries rather than eVTOL developers.

Regulators like the European Aviation Safety Authority (EASA) have set stringent safety standards, including failure rates of less than one per billion flying hours, which will only be achievable by providing redundant components to take over in case of emergency. As almost all eVTOLs are designed to be pilotless, the challenges for developers are comparable to those encountered in the development of self-driving cars. In some ways, autonomous flight of an eVTOL may be easier to achieve than autonomous driving of a car, as, once airborne, there are fewer obstacles with which to contend.

Noise is another major concern as eVTOLs are targeted at dense urban areas and thus will have to be significantly quieter than helicopters to allow for widespread use. This can be achieved by lower weight, lower rotor speeds, and a large ratio of rotor surface area to weight compared to helicopters.

Flying taxis aren’t the only application for eVTOLs

While flying taxis are one possible use for eVTOLs, delivery of goods is another. Firms such as Wing Aviation, a subsidiary of Google’s parent company Alphabet, have already started making deliveries using eVTOLs, albeit on a relatively small scale.

However, given the increased need for contactless delivery in the present crisis, drone deliveries may become more common in the coming months and years.

What can the patent landscape tell us about who is working on eVTOLs?

Use of terms related to eVTOLs in patent applications has increased significantly over the past ten years. The term “eVTOL” was first mentioned in a patent application in 2009 (AU2009202662A1), and the term “vertiport” (meaning a landing infrastructure, usually for eVTOL aircraft) was first mentioned in 2016 – but use of both has increased significantly since 2016, from 0 and 1 for “eVTOL” and “vertiport”, respectively, to 32 and 14, in 2019.

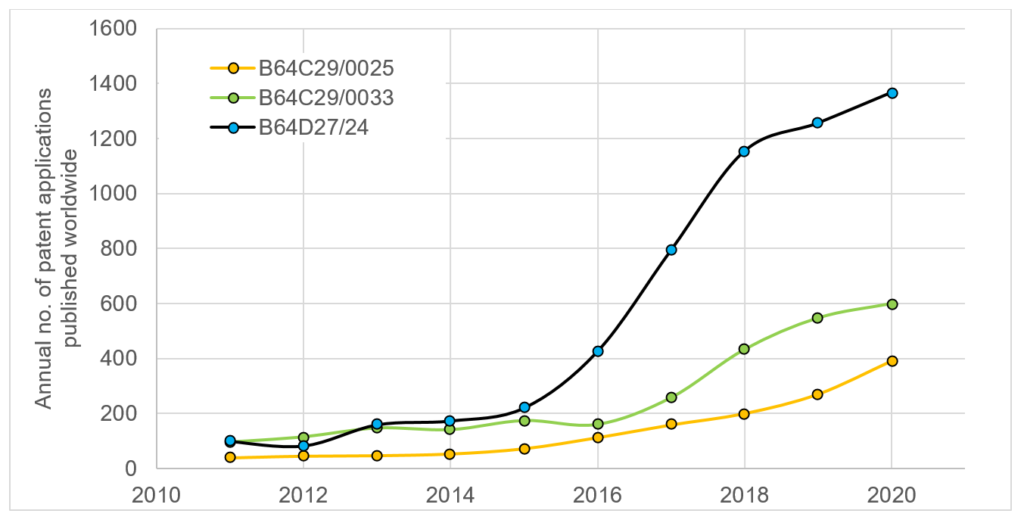

In the past ten years, the number of patent applications related to aircraft capable of landing or taking-off vertically (CPC classification codes B64C29/0025 – propellors being fixed relative to the fuselage and B64C29/0033 – propellors being tiltable relative to the fuselage) and aircraft characterised by the type or position of power plant using steam, electricity, or spring force (CPC classification code B64D27/24) has risen steadily (Fig. 1).

For CPC classes ‘25 and ‘33, the numbers have risen from 40 and 97 in 2011 to 270 and 547 in 2019, respectively. For CPC class ’24, the rise was even more pronounced, from only 99 in 2011 to 1256 in 2019. Although some of the applications using these classification codes are related to conventional helicopters rather than eVTOLs, at least some of the significant increase in recent years is driven by the increased research and IP protection of eVTOLs for flying taxis and drones.

Fig. 1 – Patent applications published per year in three CPC classes related to eVTOLs (numbers for 2020 are extrapolated from patent applications published in the first quarter of 2020).

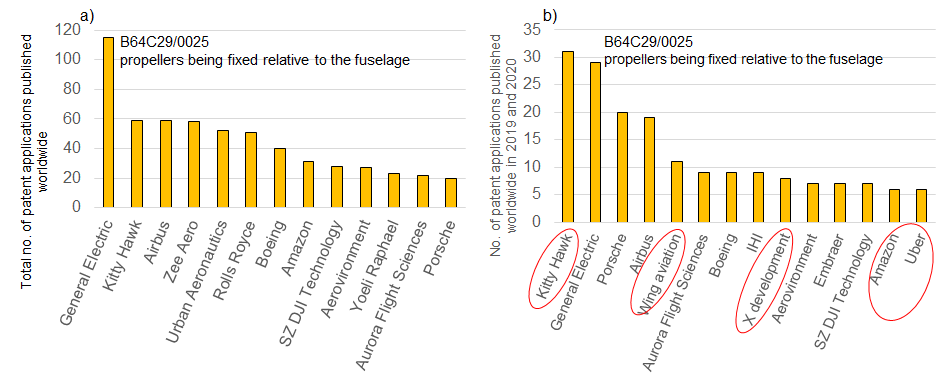

Perhaps unsurprisingly, patent applications using these classification codes are mostly filed by US companies. While traditionally General Electric has been the largest filer for VTOLs with propellors being fixed relative to the fuselage in CPC class ‘25 (2010 to 2020 – Fig. 2a), in 2019 and 2020 (as of 31 March 2020), Kitty Hawk, a US start-up backed by Google co-founder Larry Page, led the way with over 30 published appications (see Fig. 2b).

Fig. 2 – a) Total number of patent applications published for various Applicants between 2010 and 2020 in CPC class B64C29/0025; b) Number of patent applications published for various Applicants in 2019 and 2020 (until 31 March) in CPC class B64C29/0025.

Other industrial giants such as Boeing and Porsche (who partnered to build an eVTOL in 2019), Airbus, and Embraer are further well-known (and perhaps expected) heavy filers in the area. X development, a secretive R&D subsidiary of Google, had 8 applications published last year, while Amazon (presumably mostly for delivery drones) and Uber (Uber Air – a development arm for flying taxis) had 6 applications each published between January 2019 and March 2020 (see Fig. 2b).

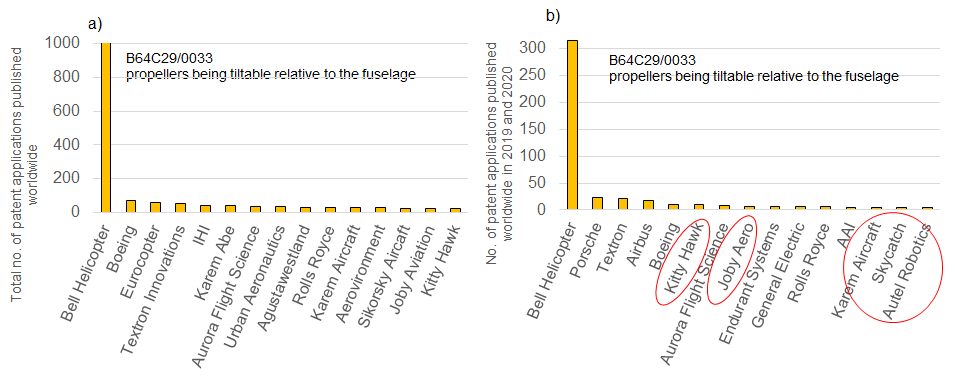

Looking at applications published for VTOLs with propellors being tiltable relative to the fuselage in CPC class ‘33, Bell Helicopter filed by far the most patent applications; over 1000 between 2011 and 2020 (Fig. 3a), and over 300 in 2019 and 2020 (as of 31 March 2020 – Fig. 3b) alone.

Fig. 3 – a) Total number of patent applications published for various Applicants between 2010 and 2020 in CPC class B64C29/0033; b) Number of patent applications published for various Applicants in 2019 and 2020 (until 31 March) in CPC class B64C29/0033.

Bell Helicopters has been working on military aircraft with tiltrotors for many years, and is agressively protecting IP for their Nexus eVTOL (a six fan, 150 mile-range “flying taxi”), which puts Bell into an excellent position to use their experience developing military aircraft to turn flying taxis from concept into commercial product.

Nevertheless, start-ups such as Kitty Hawk and Joby Aero (backed, amongst others, by Toyota) are filing more patents in this CPC class, having had 11 and 7 patent applications published, respecitively, in 2019/2020 (see Fig. 3b).

It remains to be seen when flying taxis will become a product for the mass market, and if they can revolutionise transportation. It also remains to be seen who will succeed, and who will fall by the wayside. In a similar fashion to the current automotive market, the winners and losers will come from the large OEM incumbents, and the disruptive start-ups. Nevertheless, for now, at least when looking at patent filings in the area, the US OEMs and start-ups appear to be leading the way.

This article is for general information only. Its content is not a statement of the law on any subject and does not constitute advice. Please contact Reddie & Grose LLP for advice before taking any action in reliance on it.