24/11/2020

Virgin Hyperloop recently made the news after announcing it had completed a successful trial of its hyperloop technology in Nevada, USA. During the test, human passengers were propelled along a test track in the desert at speeds of up to 107 mph (172 km/h). This article looks at how Virgin Hyperloop and its competitors are seeking to protect hyperloop innovations as they try to commercialise a technology that was first conceived over 100 years ago. A previous article looked at which companies are filing patents for e-scooter inventions.

The hyperloop concept itself is not new. It has been discussed in various forms over the years. US2511979A is a patent application filed in 1944 that describes the basics of the hyperloop concept, and this patent application includes cited prior art dating from as far back as 1848! The hyperloop concept involves using electric motors to propel a passenger or cargo pod through a sealed low pressure tube. The main advantage of a hyperloop is that the pod can travel without being hindered by air resistance. In theory, this could allow for the pod to travel at speeds in excess of 1,000 km/h.

The science behind the hyperloop concept is well-known. The difficulty has been in implementation. Hyperloop Technologies was setup in 2014 to address this problem. In 2017, Hyperloop Technologies partnered with the Virgin Group, and the company was ultimately rebranded as Virgin Hyperloop.

Virgin Hyperloop is an active patent filer, with patent applications being filed in the name of “Hyperloop Technologies, Inc.”. Data from patent search software TotalPatent One® shows that a total of 128 published patent applications in the name of Hyperloop Technologies, Inc. Since the core concept of a hyperloop is well-known, Virgin Hyperloop seems to be filing patent applications for inventions resulting from how it is solving specific problems associated with building and maintaining a hyperloop.

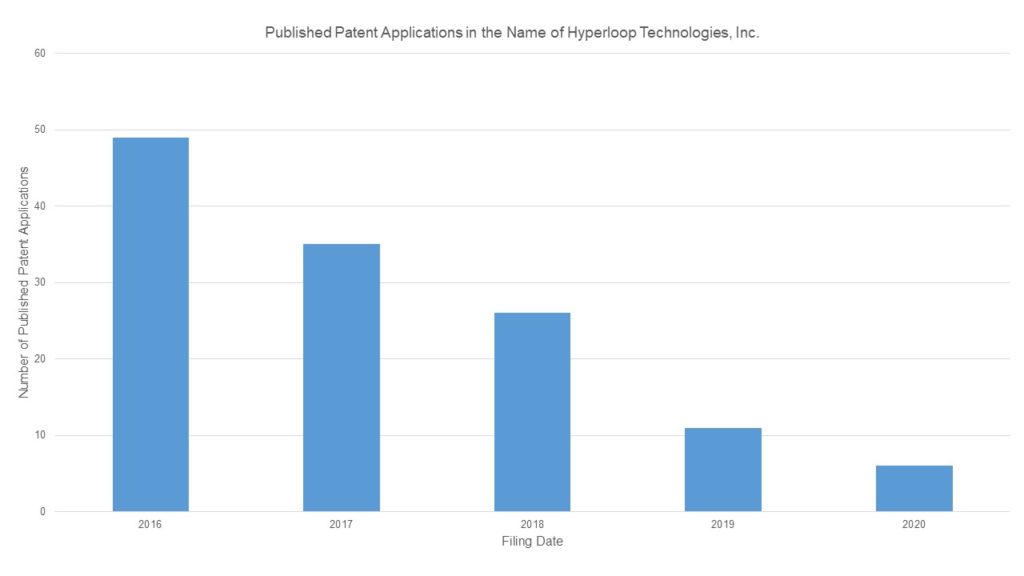

Figure 1

Figure 1 above shows the number of published patent applications in the name of “Hyperloop Technologies, Inc.” filed since 2016. When looking at this graph, it is important to bear in mind that patent applications usually only publish 18 months after they have been filed. This time lag likely explains why there are significantly fewer applications dated 2019 and 2020- the applications may not have published yet. As can be seen, Virgin Hyperloop is a steady patent filer, though the number of patent application seems to have peaked back in 2016.

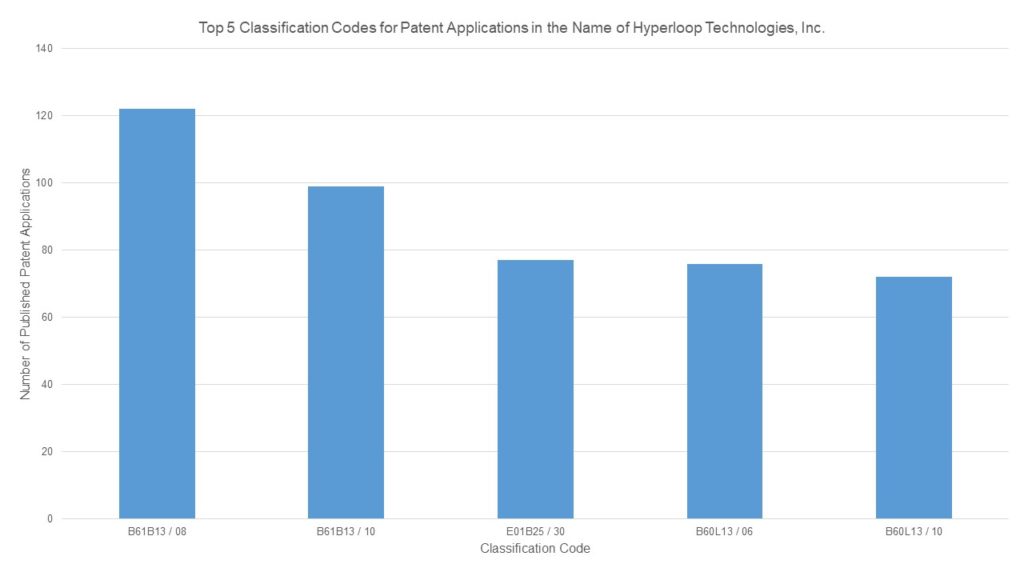

Figure 2

If we want to look at patent activity in the hyperloop sector more generally, we can make use of patent classification codes. Patent classification codes are assigned to patent applications by patent offices to allow applications to be sorted into different categories. This makes patent searching easier. Figure 2 shows the most common patent classification codes under the Cooperative Patent Classification (CPC) system for published patent applications filed in the name of Hyperloop Technologies, Inc. The two most common CPC codes for published patent applications filed in the name of Hyperloop Technologies, Inc. are:

B61B13/08 covers: other railway systems – sliding or levitation systems (vehicles with air cushions between rails and vehicles).

B61B13/10 covers: other railway systems – tunnel systems (pneumatic tubes conveyors).

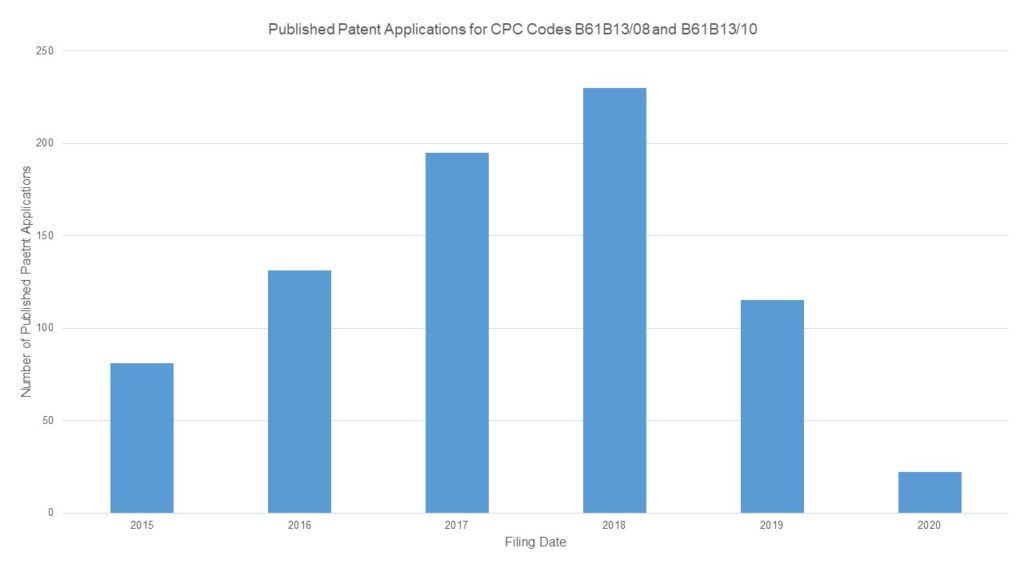

Figure 3

Data from patent search software TotalPatent One shows us that the number of patent applications filed for hyperloop inventions increased significantly from 2015 to 2018 (see Figure 3). The number of patent applications being filed for hyperloop inventions appears to have dropped off in 2019 and 2020. However, as discussed with respect to the Figure 1 above, the number of patent applications actually filed in 2019 and 2020 may be different to what is shown in Figure 3. This is because patent applications that have been filed in 2019 and 2020 may not yet have been published. In any event, it is clear that patent activity in this space has increased significantly over the last few years compared to 2015.

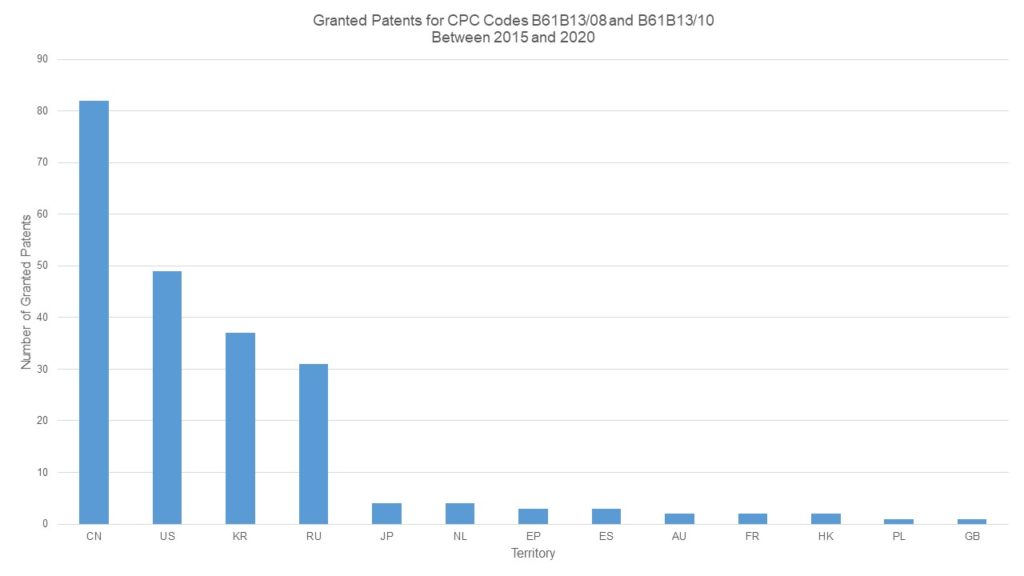

Figure 4

A patent application itself is not enforceable. A patent application only becomes enforceable in a particular territory once it has granted into a patent. Figure 4 shows the territories in which patents have been granted for hyperloop inventions having the above mentioned patent classification codes. The number of patents granted in China for hyperloop inventions is significantly greater than in any other territory. Besides China, it seems that the vast majority of granted patents in the hyperloop space are concentrated in the US, South Korea and Russia. There are currently only a handful of granted European patents for hyperloop inventions. A closer look at patent application data shows that although 40 European patent applications for hyperloop inventions were filed between 2015 and 2020, only 3 have been granted by the European Patent Office so far.

Data from patent search software TotalPatent One also reveals the names of the most active patent filers between 2015 and 2020 for the two patent classification codes identified above. In other words, the applicants are the top filers of patent applications concerning hyperloop inventions. From this data, Hyperloop Technologies (i.e. Virgin Hyperloop) is the top filer, with significantly more patent applications filed than any of the other applicants. However, it is important to bear in mind that the patent classification codes on which the data is based were initially selected from patent applications filed by Hyperloop Technologies, so the data used could be skewed in favour of Hyperloop Technologies. Other points of interest are that three Chinese universities (Southwest Jiaotong University, Xijing University, and Jiangxi University of Science and Technology), a Chinese individual (Bincheng SU), and a US aerospace company (Boeing) are all filing patent applications for hyperloop technologies.

In summary, the number of patent applications being filed for hyperloop related inventions appears to be increasing year on year, although the number is still quite low compared to other transportation sectors. We expect that this number will keep increasing over time, especially if some of the larger conventional rail companies become more interested in hyperloop technology. It is also noteworthy that aerospace companies are actively starting to file patent applications in the hyperloop space, because travelling by hyperloop is seen by some as a potential future alternative to a short-haul flight (see here and here).

Reddie & Grose can help you with all aspects of intellectual property in the transportation sector. If you have any intellectual property issues that you would like to discuss with us, please get in touch.

This article is for general information only. Its content is not a statement of the law on any subject and does not constitute advice. Please contact Reddie & Grose LLP for advice before taking any action in reliance on it.