07/05/2024

The electronics industry traditionally relies on silicon chips, from computers and smartphones to automobiles and industrial equipment. However, silicon could be reaching its physical limits in the face of continued demand for faster computing and smaller devices. Silicon chips are stepping aside as a new wave of materials and designs takes the spotlight. With improved performance, efficiency, and power handling at the forefront, these advancements offer a boost in power handling and a decrease in power consumption.

Market forces are pushing the shift from silicon microchips to silicon carbide (SiC). The electric vehicle industry and the Internet of Things lead the way, requiring more efficient and dependable microchips. For instance Tesla, aware of supply chain problems, became the first to use silicon carbide chips in their Model 3. Now more companies are moving to using SiC chips.

Intellectual property has always played a central role in the semiconductor sector, with different types of companies requiring different intellectual property strategies. The semiconductor sector is going through some big changes. How semiconductor companies react to protect their market position will undoubtedly have an impact on their long-term futures. In this article, we review how Silicon Carbide innovations are shaping the semiconductor market.

Why Silicon Carbide?

Silicon carbide (SiC) is a fascinating wide-bandgap semiconductor for high-temperature, high-power and high-frequency applications. Its high corrosion and radiation resistance makes it a key material with great potential for a wide range of environments. Although it has been known for a long time, it is only recently that the availability of large size, high-quality SiC wafers has become a reality.

More than 250 different polytypes of SiC exist, distinguished by differences in the stacking sequence of the identical planes of silicon and carbon atoms. The primary commercially available polytypes relevant to SiC device applications are 4H-, 6H- and 3C-SiC. Out of these, 3C-SiC is the only polytype that can be synthesised on Si substrates because it is a stable low temperature polytype of SiC, while 4H- and 6H-SiC are typically grown at temperatures above the melting point of Silicon (1400oC).

Silicon carbide has a long history of being grown for a vast array of applications, starting with the first LED in 1907, and then progressing to bulk wafer growth in the 1950’s. Today the SiC device market is valued at around $2 billion and is projected to reach a value of $11 billion to $14 billion by 2030. Given the spike in electric vehicle (EV) sales and SiC’s compelling suitability for inverters, most of SiC’s demand is expected to come from EVs.

Challenges Facing Silicon Carbide Production

The main challenge for the production of silicon carbide involves the characteristics of the material. Due to its hardness (almost diamond-like), SiC requires higher temperatures, more energy, and more time for crystal growth and processing. Because SiC is the third-hardest composite material in the world and is also very fragile, its production poses complex challenges related to cycle time, cost, and dicing performance. In addition, the most widely used crystalline structure, 4H-SiC, is characterized by high transparency and high refractive index, making it difficult to inspect the material for surface defects that could potentially affect epitaxial growth or final component yield.

As the industry shifts to more 200mm wafers, further issues may arise. While an increase in the size of the wafer offers the advantage of drastically reducing the unit cost of the components, it imposes demanding challenges regarding the elimination of defects and increasing the reliability of the delivered semiconductor. It will be necessary to guarantee the same quality of the substrate, regardless of an inevitably higher density of defects.

The Patent Landscape of Silicon Carbide Technology

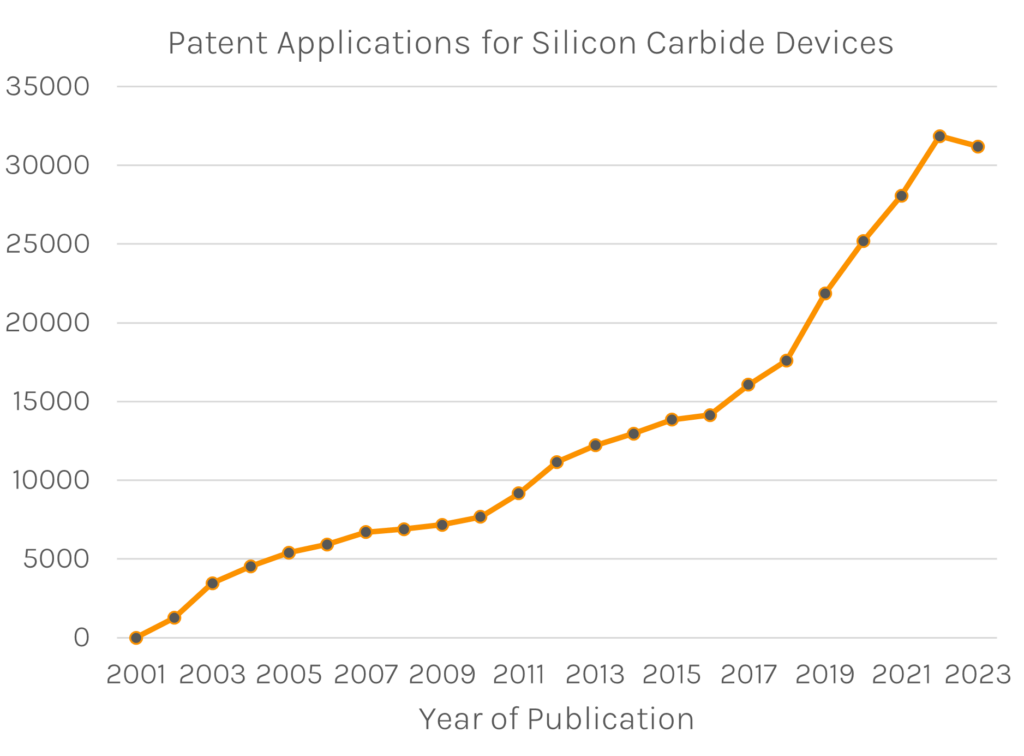

Despite the challenges posed above, the patent landscape shows that the commercialisation of silicon carbide technology is continually progressing. In the past two decades, there has been an upward trend in patent applications relating to silicon carbide in electrical and electronic devices. Beginning with only 3 applications in 2001, there has been consistent growth annually in the number of applications published (see Figure 1).

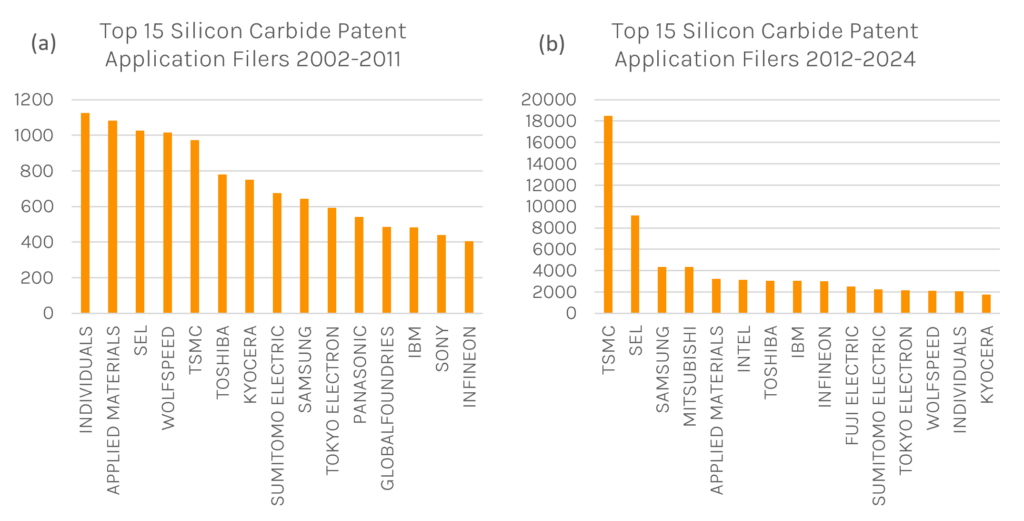

The investment in SiC technology is continually led by Asian companies. While SiC technology innovation was previously led by individual researchers (see Figure 2a), in the last decade, Taiwan Semiconductor Manufacturing Company (TSMC) has dominated the number of patent filings related to SiC (see Figure 2b). In China and Japan, there is an impressive number of IP players engaged in SiC substrate R&D, and some of them are now stand-out players in the bulk SiC patent landscape.

East Asian manufacturers are accelerating their patenting activity to support the development of SiC technology and, more importantly, to support the emergence of a complete domestic supply chain and secure their power semiconductor product lines. Furthermore, in China, where anticipated EV demand is highest, companies are projected to drive a large portion of the overall demand for SiC in EV production.

Future Opportunities

The road to the widespread adoption of these innovative technologies takes time and effort. Silicon carbide materials may have defects like microcracks, grain boundaries, or dislocations that can affect performance, and navigating these obstacles is crucial for a smooth journey toward industry growth.

Numerous companies are focusing on building a vertically integrated supply chain to secure their SiC business in the long term. As such, there is potential for the protection of intellectual property at many stages of the supply chain. Established companies holding key patents at all stages of the supply chain can expect a long-term competitive advantage in the market.

It seems that European countries are aware of the shortage of semiconductor research compared to Asian countries. The UK announced its National Semiconductor Strategy last year, and has recently joined the EU’s “Chips Joint Undertaking” (€1.3 billion research funding pot) to boost the UK’s strengths in semiconductor science and research. This year, the Chips Joint Undertaking fund included focussed calls for funding bids on semiconductors for electric cars and other vehicles. With EVs driving an increased demand for SiC technology, it remains to be seen which companies will be able to protect the most important inventions.

If you would like any advice on how, and what, developments to protect in this area or any other related area such as semiconductor technology or electric vehicles, please get in touch.

This article is for general information only. Its content is not a statement of the law on any subject and does not constitute advice. Please contact Reddie & Grose LLP for advice before taking any action in reliance on it.