03/04/2019

It is a well known fact of UK and European Patent law that, although computer software “as such” is generally excluded from patent protection, computer software that makes a “technical” contribution may escape the exclusion and enjoy patent protection.

Since the Landmark Graphics Corporation decision of 2018 (see my report here), the UK IPO appears to have been prepared to take a more favourable approach towards computer software falling on the borderline of what is considered allowable. Such cases, having received an initial refusal from the UK IPO Examiner, have come before the Hearing Officer of the UK IPO for consideration and subsequently the Hearing Officer’s decision has been published by the UK IPO. The link to the Hearing Officers’ decisions is found here.

Decisions of the Hearing Officer

In the 12 months since March 2018, when the Landmark Graphics Corporation decisions issued, there have been 6 decisions of the hearing officer overturning an initial finding of the Examiner that a software related patent application related to excluded subject matter. Against this, in 29 decisions, the Hearing Officer endorsed an Examiner’s initial finding that the subject matter of the application was excluded. The success rate for applicants pursuing a rejection to the Hearing stage is therefore currently around 20%.

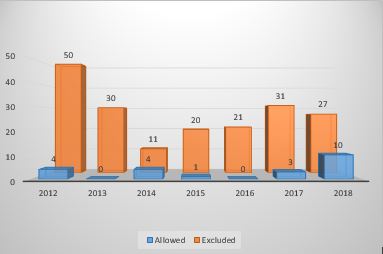

This may not sound like a large number, but it is worth keeping in mind that it demonstrates an apparent improvement compared with previous years. The number of Hearing Officer decisions, issuing between 2012 and 2018, confirming that the subject matter of an application is excluded from patentability (Excluded) or is not excluded from patentability (Allowed) is shown in the graph below.

Although 2018 shows a high of 10 favourable decisions (relating in total to 22 applications decisions sometimes relate to more than one patent application), 7 of these decisions related to Landmark Graphics Corporation applications, and were based on essentially the same reasons for patentability. These decisions skew the data quite considerably. Had the Hearing Officer taken the opposite view (finding the technology in Landmark Graphics Corporation essentially unpatentable), the data for 2018 would have been 34 decisions confirming excluded subject matter, and only 3 confirming allowable subject matter.

However (and ignoring the Landmark Graphics Decisions themselves), 6 allowable decisions have issued in the past twelve months. That is more than any other calendar year so far. In the first few months of 2019 alone, 3 applications reaching the Hearing Officer have been found not to relate to excluded subject matter, compared with only 8 applications found to be excluded. Again, that is a figure that is more favourable than any other calendar year so far. Although 2014, appears also to have a favourable ratio of allowed cases to excluded cases, the data for that year is also skewed by fewer decisions overall.

Conclusions

The number of Hearing Officer decisions is small, and so it is difficult to draw meaningful conclusions. Nevertheless, the indications are that, either beginning with the Landmark Graphics Corporation, or because of it, the UK IPO is now tending to take a slightly more positive approach to subject matter that would otherwise have been found excluded from patent protection.

We think this is the right approach, and hope to see more data supporting our tentative conclusion over the coming months

Notes

The graph above counts the number of decisions only, and some decisions may therefore refer to multiple applications. These are counted as one decision, due to similarities in the subject matter under consideration.

When considering these figures, it is important to note however that they are only one indication of the UK IPO patent office approach to excluded subject matter. Some applications on the borderline of patentability may have been allowed without a hearing ultimately being necessary, while some applications would have been abandoned by the applicant before the internal review stage was reached.

Hearings at the UK IPO provide the applicant with a formal review of the application, in cases where the Examiner and applicant cannot agree on a point of law as it applies to the application. The Hearing office considers the matter in detail and provides a judgement, either upholding the Examiner’s view or accepting the applicant’s position.

This article is for general information only. Its content is not a statement of the law on any subject and does not constitute advice. Please contact Reddie & Grose LLP for advice before taking any action in reliance on it.