01/10/2020

Last week, the European Patent Office (EPO), together with the International Energy Agency (IEA), released a detailed report on patenting activity in electricity storage between 2000 and 2018. An EPO press release is available on the EPO website along with the full report.

The EPO reports that the annual number of patent families [1] related to electricity storage has increased more than sevenfold since 2000. In comparison, the annual number of patent families in all fields has grown more slowly, substantially doubling in the same period.

Most of the report’s findings may not come as a surprise to those interested in the field. For example, inventions in the batteries (and other electrochemical electricity storage devices) account for almost 9 out of 10 patent families in electricity storage, far outstripping inventions in electrical storage (such as capacitors; 9 %), thermal storage (such as molten-salt; 5%) and mechanical storage (such as flywheels; 3 %); n.b. some inventions fall into more than one category. Li-ion batteries are responsible for a large part of this growth, with over 2500 new patent families related to Lithium and Li-ion batteries filed in 2018.

As previously reported, the electrification of transportation is a main driver of innovations in battery technology. The annual number of patent families related to battery packs for automotive applications has increased from less than 20 in 2000 to over 700 in 2018. However, battery packs for portable applications and for stationary applications have also been the subject of a continuously increasing number of patent applications.

But what can the report tell us about the present and future of electricity storage?

The top applicants for battery technologies

Perhaps unsurprisingly, the top five applicants for battery technology patents is a who-is-who of prolific technology and automotive companies: Samsung, Panasonic, LG Electronics, Toyota, and Bosch. The only European company in the top ten applicants is Bosch, with two Korean and seven (!) Japanese companies rounding out the top ten.

Although US originating patent families have been rising steadily, they have been rising more slowly than those from other jurisdictions, and 2018 was the first year in which there were more Chinese originating battery technology patent families (876) than ones from the US (817).

What’s happening in Lithium-ion batteries?

Although it may be more exciting to look at the radical new technologies being developed, incremental improvements in Li-ion batteries since their commercial introduction in 1992 by Sony, have seen their energy storage and power capability (which influences charging speeds) increase significantly, while prices per kWh have plummeted.

Some of the major improvements in Li-ion technology have come from better materials, in particular better active materials in cathodes and anodes. The EPO/IEA report highlights both cathode and anode materials which have seen the most innovation (and hence, patenting activity) in the last 20 years.

Cathodes

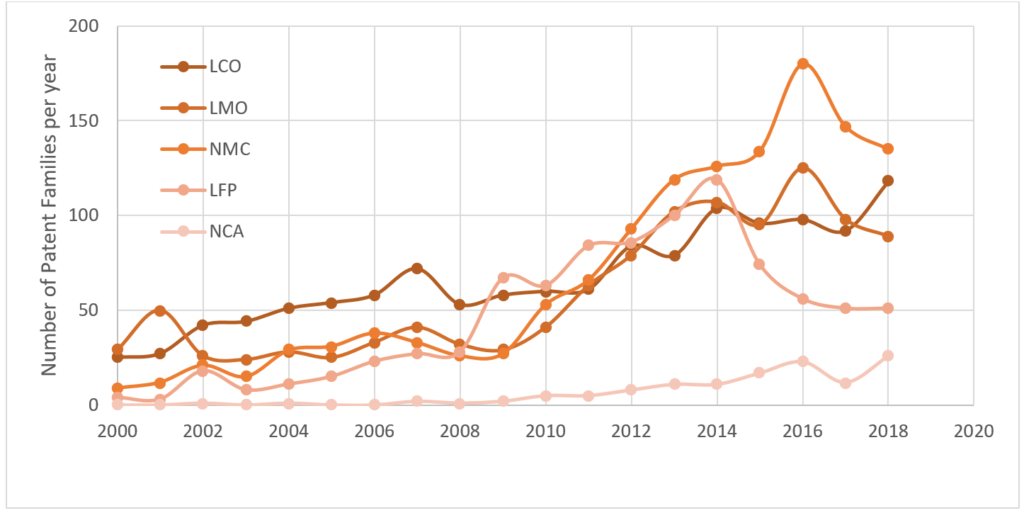

Regarding cathode materials, the report highlights five materials which have seen the most interest. These materials are:

- LiCoO2 (LCO);

- LiMn2O4 (LMO);

- LiNixMnyCozO2 (NMC);

- LiFePO4 (LFP); and

- LiNixCoyAlzO2 (NCA).

As most involved in the manufacture or research of Li-ion batteries would expect, LCO, the currently most commonly used cathode material, has consistently been one of the most patented.

Because the supply of cobalt, which is the main constituent of LCO, is limited, patenting activity related to the Cobalt-free (LMO and LFP) and low-Cobalt alternatives (NMC and NCA) has increased significantly in the last 10 years.

Interestingly, the annual number of patent families related to LFP appears to have steadily declined since 2014, perhaps because of its limited capacity. In comparison, interest in the automotive industry in the well-established NMC and the more-recently developed NCA (already being used in batteries for electric vehicles, e.g. by Tesla) has driven much higher patenting activity for these materials.

Figure 1 – Annual number of patent families related to various cathode materials (data from REPORT)

The above suggests that interest in LCO will continue, and greater proliferation of electric vehicles will drive more patenting activity in NMC and NCA, particularly to improve their safety as compared to LCO.

What about “next generation” electricity storage

The EPO/IEA report also considers more radical areas of innovation in electrochemical energy storage, such as solid-state batteries – the remarkable rise of which we have previously reported.

Some other emerging technologies include redox flow batteries and supercapacitors.

Redox flow batteries

Redox flow batteries rely on fluids (anolyte and catholyte) being pumped to respective porous electrodes, separated by a membrane which allows for ion exchange between the electrodes, to produce an electrical current. They are considered batteries because they can be recharged by regenerating the spent fluids once there are no more ions to exchange.

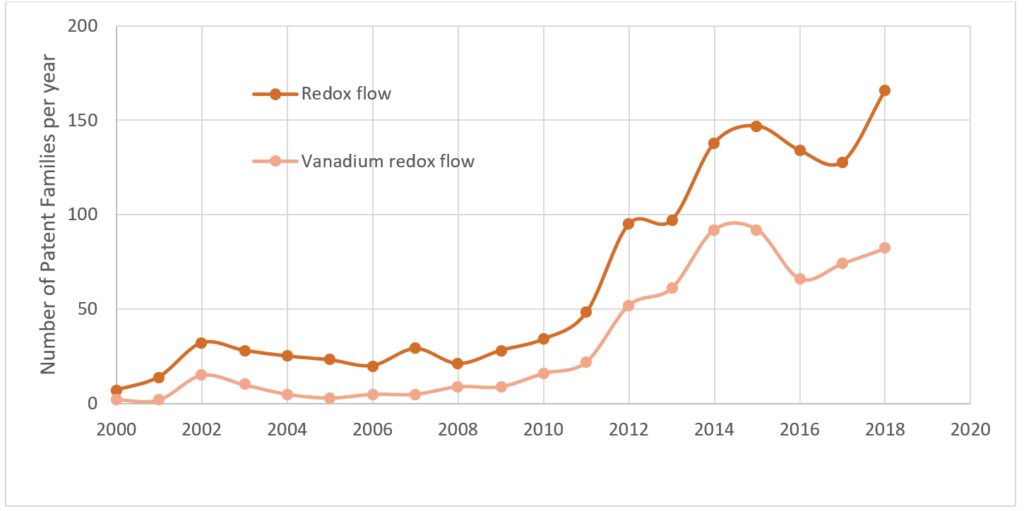

Vanadium is the most commonly used active redox material, because it can exist in solution in four different oxidation states (V5+ to V2+). This is borne out in the patent data, which shows that patenting of vanadium redox flow batteries and other redox flow batteries has increased more than 20-fold between 2000 and 2018 (see Figure 2).

Figure 2 – Annual number of patent families related to redox flow and vanadium redox flow batteries (data from REPORT)

Unlike many of the other fields of electrochemical energy storage detailed in the report, the top five applicants in redox flow batteries include companies from both the US (Lockheed Martin and United Technology) and the UK (Acal Energy).

Supercapacitors

Another highlighted emerging area of technology are supercapacitors. These include hybrid capacitors, pseudocapacitors, and electrochemical capacitors, which combine electrical energy storage (as found in capacitors) with electrochemical energy storage (as found in batteries) and can provide fast charging and relatively high energy density, often by using one battery electrode material and one supercapacitor electrode material (e.g. high surface area carbon).

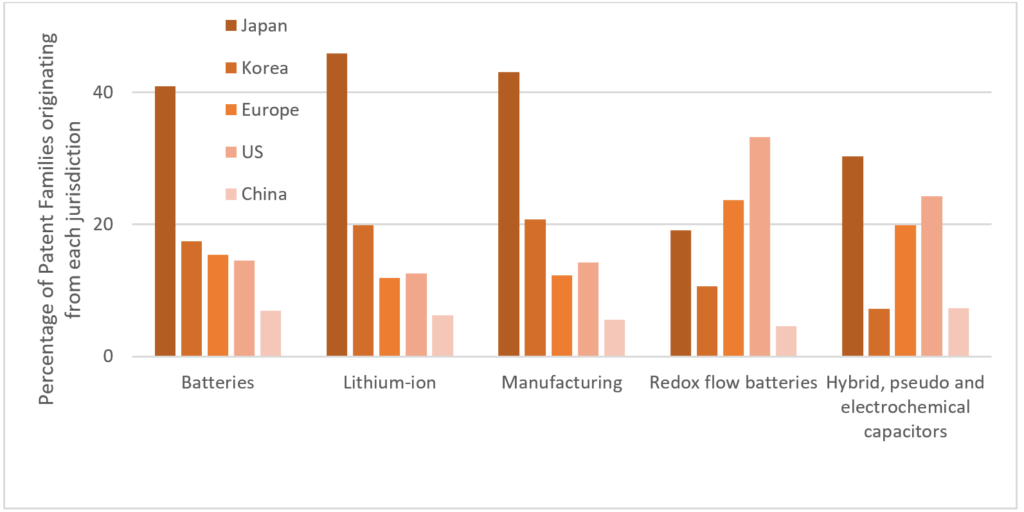

The number of patent families related to hybrid, pseudo, and electrochemical capacitors has increased from 33 in 2000 to 200 in 2018. Although Japanese companies dominate patent filings for supercapacitors and electrostatic capacitors (with about half and two thirds of all patent families, respectively) as they do for batteries overall and Li-ion batteries and battery manufacturing in particular, the picture in hybrid, pseudo and electrochemical capacitors is different (see Figure 3). Japanese companies account for about 30 % of the patent families in this field, whereas US companies account for 24 % and European companies account for 20 %.

Figure 3 – Geographic origin of patent families related to batteries generally; Li-ion batteries; battery manufacturing; redox flow batteries; and hybrid capacitors, pseudocapacitors, and electrochemical capacitors (data from REPORT)

So what does the report tell us about the future of electricity storage?

As most may have already expected, Asian companies dominate innovation in electricity storage, in particular batteries, with large Japanese and Korean conglomerates responsible for most innovation in battery technology and filing the most battery patent families.

However, there are some, perhaps more radically innovative, areas of electricity storage in which US and European companies appear to be relatively more active, such as redox flow batteries and hybrid capacitors, pseudocapacitors, and electrochemical capacitors.

Nevertheless, although these radically new areas show promise, development in Li-ion batteries is ongoing and responsible for most patenting activity in electricity storage. It would seem that Li-ion batteries will be around for a long time, and even if the emerging technologies become economic reality, Li-ion battery developers appear to be in good stead to continue incrementally driving down cost and up energy and power density.

We will continue to follow any developments in the field with great interest. Our multidisciplinary team has relevant research experience in electricity storage, and valuable experience in protecting intellectual property in this field. Reddie & Grose is set up to deal with inventions in all aspect of electricity storage, including chemistry and materials, processing and manufacturing, and software and electronics.

[1] “Patent families” here, as in the EPO/IAE report, refers to an invention for which patent applications were filed and published in at least two countries.

This article is for general information only. Its content is not a statement of the law on any subject and does not constitute advice. Please contact Reddie & Grose LLP for advice before taking any action in reliance on it.