21/12/2021

This decision of the UK High Court relates to the expected standard of behaviour of a Standard Essential Patent (SEP) holder and a potential licensee involved in a patent dispute, and considers the opposing arguments put forward by Optis and Unwired Planet (as patentee) and Apple (as defendant) seeking to determine the correct approach to negotiating a licence on Fair Reasonable and Non-Discriminatory (FRAND) terms.

The case is essentially a case about i) timing, ii) the behaviour of the parties, and iii) the discretion of the court to provide an injunction to the proprietor of one or more infringed SEPs. Specifically, the case considers whether a potential licensee, who is found to infringe one or more SEPs, but who does not commit to taking a FRAND licence as soon as infringement of the patent holder’s rights is found, could in fact be engaged in patent “hold out”, a deliberately obstructive tactic in SEP licence negotiations designed to put the patent holder in a detrimental position. Is such a licensee a “willing licensee” entitled to protection against the threat of an injunction, or does their refusal to be bound by the terms determined by the court essentially make them “unwilling” and therefore exposed to such a penalty?

The decision was handed down on 27 September 2021 following a hearing that took place between 19 and 27 July 2021, and is “Trial F” in an ongoing sequence of SEP related trials, and builds on a series of UK court decisions, such as that heard last year in Unwired Planet v Huawei (Supreme Court) [i].

Background (Trials A to E)

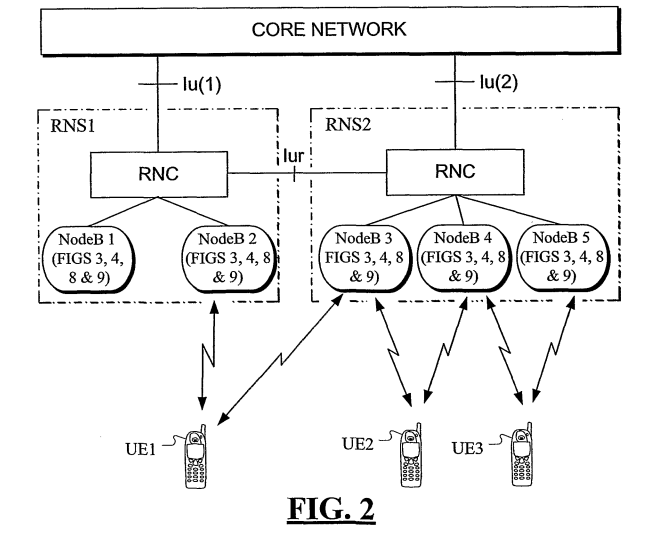

Optis and Unwired Planet (“Optis”) took legal action in the UK in February 2019 to enforce a number of European Patents (UK) relating to 3G and 4G standard against Apple. Optis argued that 8 of its telecommunications patents relating to 3G and 4G had been infringed by Apple, who were implementing its technology in their well-known IPhone and IPad devices.

A number of technical trials (trials A to D) were scheduled to take place between October 2020 and January 2022 to determine the validity of Optis’ patent rights and whether they were patent essential, before a final FRAND trial (Trial E) took place in which the competition law defence raised by Apple and the appropriate form of any relief (e.g. the terms of a FRAND licence) would be considered by the court. The date for Trial E was scheduled for June and July 2022 before any of the technical trials had taken place and before any of the patents were found valid and infringed. Following trials A and B in October 2020 and April 2021, Apple was subsequently found by the High Court to infringe two of Optis’ patents, EP (UK)1230818B and EP (UK) 2229744B. Trials C and D are in progress with decisions expected.

Although the separate sequencing of the trials allows the UK courts and the parties time to fully consider each of the issues raised in the dispute (and is therefore advantageous for active case management), in this case it has meant Optis having to wait nearly three and a half years from its initial claim before it can potentially receive relief from the UK court against Apple. In the meantime, Optis and Apple’s discussions around a potential SEP licence broke down, at least in part due to a fundamental disagreement on whether royalties should be calculated based on the price of the product (the whole device) or based on the price of the baseband chip only. Although Apple did accept that the terms of any licence would be global and not limited to just the UK market, Apple alleged that Optis is abusing its dominant position by seeking exorbitant licensing rates. Similarly, Optis accuses Apple of “holding out”.

Against this backdrop, and in the summer of 2020, Optis amended its case to seek a separate trial on the question of whether Apple is an “unwilling licensee” and therefore unable to rely on Optis’ FRAND commitments to ETSI to offer a licence on FRAND terms. If found to be an unwilling licensee, Apple could be injuncted against infringing Optis patents in the UK, without the need to have the separate FRAND and completion law trial E in the summer of 2022. Despite Apple’s objections, the court agreed to a separate trial (now Trial F in the sequence despite taking place before Trial E) on the basis that “the issues to be dealt with at the two trials [E and F] could be distinguished and that there was a real prospect that the determination of a Trial F might lead to the possibility of settlement between the parties” (see [2020] EWHC 2033 (Pat)). Lastly, in October 2020, Apple gave a contingent undertaking to accept the terms of a court appointed license, unless the court later decides that such an undertaking would be unnecessary or entered into too late.

Trial F – The issues

This brings us to the trial in September 2021.

The case is a complicated one, and raises four issues, (1) the proper interpretation of clause 6.1 in ETSI’s IPR policy, (2) competition law defences, (3) the court’s discretion to award an injunction, and (4) whether Apple’s conditional undertaking to accept a court determined FRAND licence has any meaningful effect on the course of the court proceedings. All of these issues relate to the conduct of the parties in the negotiations, what is expected of them, and penalties available to the other if one party behaves badly. Issues 1, 2 and 3 are discussed briefly below before coming on to the resulting conclusions:

Issue 1: The requirement on the parties envisaged by Clause 6.1 of ETSI’s IPR policy

Optis had sought an injunction against Apple during the scheduled court proceedings because Apple had not been prepared to unconditionally to commit to taking a FRAND licence on the terms determined by the court. Optis had argued that Apple receives the benefit of Optis’ FRAND undertaking (to provide a license and not injunct the potential licensee) without the burden (Apple is essentially able to continue to infringe and benefit from the standard up to the Trial E and possibly beyond). Optis’ argument is set out in more detail in paragraph 58 of the decision:

“Optis says that an implementer which wants to take advantage of a SEP holder’s FRAND undertaking must engage constructively in negotiations and if no agreement is reached must commit to take a licence on terms decided by a Court. The implementer’s commitment must, Optis says, be given either when the SEP holder unequivocally commits to give a FRAND licence, or, alternatively, when there is a finding of validity and infringement. Failing that, Optis says that the implementer is not a willing licensee, and irretrievably loses the right to a FRAND licence. Thus Optis contends that an implementer must commit to a Court-determined FRAND licence in advance of knowing its terms”.

Optis therefore seeks to establish that the potential licensee must demonstrate its willingness to licence by committing to a court appointed licence either at the beginning of negotiations, or at the latest when there is finding of infringement, and that the penalty for not doing this is the loss of the FRAND licence envisioned in ETSI’s IPR Policy. If true, this would have the effect of allowing the SEP holder to obtain licence terms higher than those considered FRAND, and to have access to an injunction against further patent infringement.

Apple however had countered that clause 6.of the ETSI IPR policy 1 does not “explicitly state any obligation on the part of the implementer to agree to take a FRAND licence” and rejected Optis’ view of the timing with which any undertaking needed to be given. Again referring to paragraph 58 of the decision:

“Apple on the other hand says that clause 6.1 contains no limitation other than that the implementer seeks a licence. Accordingly, an implementer can meet that minimal requirement at any time, and is entitled to wait until the Court’s decision about what FRAND terms are, and then make a decision. Apple also notes that French law has a principle of good faith in the performance of contracts, and it says that that is the solution for a case where an implementer which says it wants a licence is actually holding out. But Apple says that that requires a fact-sensitive assessment”

Issue 2: Competition Law Issues

In the proceedings, Apple had raised a competition law defence, alleging that Optis:

i) Has never made an offer which is FRAND;

ii) Only made offers which are so far in excess of FRAND that they disrupted negotiations; and

iii) Abused its dominant position thereby, and by seeking the relief that it does at this trial, with the objective of getting royalty rates far in excess of FRAND

In turn, Apple argues that it made an offer which was FRAND. Such matters are in fact reserved for discussion in the competition law aspects of Trial E, the court consequently assumed for Trial F that Apple’s arguments were correct. Similarly Optis’ position is that:

i) Apple has not committed to take the Court-determined FRAND licence that will result from Trial E; and

ii) Optis has committed to grant a licence on those terms, and did so from the inception of these proceedings, in its initial statements of case

Optis sought to argue that these points i) and ii), mean that Apple’s competition law arguments must fail in the light of the CJEU’s Huawei and ZTE decision (more below), even if the above facts are assumed in Apple’s favour, and the any abuse of a dominant position at Trial E could not lead to the withholding of an injunction only damages.

Issue 3 : Discretion

On issue 3, Apple had also argued that that “an injunction is a discretionary remedy, and that that discretion can only properly be exercised following Trial E”. In a separate argument, Apple had also stated that “it would be unfair that it has to commit to FRAND terms without knowing what they are because of mere procedural “happenstance” leading to a gap between the finding of infringement and the FRAND trial”. The court showed no sympathy with this argument pointing out that “The sequencing of the trials in this litigation was resolved by the Court with care after hearing from the parties, who were able to make such submissions as they wanted” and that consequently “It is not happenstance that there is a gap between Trial B and Trial E”.

Issue 1: Correct Interpretation of Clause 6.1 of ETSI’s IPR Policy

For reference, the wording of clause 6.1 is reproduced here, though it would not appear to definitively answer the arguments of the parties, and as such is open to interpretation. To resolve this the court necessarily considered expert evidence and reviewed the guidance followed in the Unwired Planet Supreme Court decision (“UPSC”) discussing the wider context of the ETSI IPR Policy:

Clause 6.1 of ETSI’s IPR Policy is as follows (emphasis added):

“When an ESSENTIAL IPR relating to a particular STANDARD or TECHNICAL SPECIFICATION is brought to the attention of ETSI, the Director-General of ETSI shall immediately request the owner to give within three months an irrevocable undertaking in writing that it is prepared to grant irrevocable licences on fair, reasonable and non-discriminatory (“FRAND”) terms and conditions under such IPR to at least the following extent:

– MANUFACTURE, including the right to make or have made customized components and sub-systems to the licensee’s own design for use in MANUFACTURE;

– sell, lease, or otherwise dispose of EQUIPMENT so MANUFACTURED;

– repair, use, or operate EQUIPMENT; and

– use METHODS.

The above undertaking may be made subject to the condition that those who seek licences agree to reciprocate.”

In making sense of this, the court noted that paragraph 76 of the Unwired Planet Supreme Court decision “explicitly identifies the twin purposes of the ETSI IPR Policy in addressing hold-up and hold-out, and in that light identifies the internal and external context relevant to the interpretation of clause 6.1”. Thus,the purpose of ETSI’s IPR Policy is that it:

“creates a contractual modification to the general law of patents to serve a fair balance between fair reward for patent owners and the need for implementers to have access to standardised technology;

With the need for balance in mind, the court noted that:

It is an explicit part of the Court’s reasoning … that hold-out is a real threat that needs addressing. It calls out the risk that implementers could use such a strategy to prejudice SEP owners, and it says (as is plainly the case) that this is reflected in clause 3.2. I mention this because I think much of Apple’s expert evidence in this trial was directed to trying to argue that hold-out is not a real problem, or affects implementers and SEP owners equally. The Supreme Court plainly concluded otherwise, and it is not legitimate for Apple to try to go behind the conclusion, especially since it was one as to the interpretation of the ETSI IPR Policy.

The question of balancing the interests of the parties was then explored at length in decision based on economic evidence presented by (among others) Prof Joseph Farrel of UC Berkeley for Apple and Dr Gunnar Niels for Optis and will be reviewed briefly here. It is interesting in its own right both for better understanding the motivations of the parties and in understanding how the court reached its decision.

The Sight Unseen (SC) and Informed Choice (IC) Approach

Prof Farrell, acting for Apple, sought to submit a model of how a “rational and economically self-interested potential SEP licensee” would have two courses of action open to it, a “Sight Unseen” situation in which the licensee finding itself in SEP litigation had to commit to a licence set by the court, that licence being worldwide, and an “Informed Choice” situation where the same licensee could choose whether or not to take the worldwide FRAND licence set by the court, after knowing what the terms were. Apple’s position was essentially that it should be allowed to follow the informed choice (IC) approach in proceedings, while Optis favoured Sight Unseen. The court recognised that these terms were slightly loaded in Apple’s favour, but proceeded on the basis that they served as useful labels. Under the IC situation (See paragraph 167):

“the potential licensee could reject the terms found by the Court once those were set, but at the price of being injuncted in the UK. That would mean the parties’ dispute would be unresolved, and the SEP holder would have to pursue litigation in another jurisdiction. Prof Farrell envisaged that the potential licensee would not necessarily actually leave the UK market, because the parties, as part of what he called a “post-rejection process” might still settle against the background of the Court’s rate to avoid that. If so, the rate would inevitably be lower than that set by the Court”.

Further, referring to paragraph 173:

“under IC, if the FRAND rate set by the UK Court sufficiently exceeded what the potential licensee thought another Court in another jurisdiction would award, and the UK sales of the potential licensee were only a small proportion of its total sales, then it would be economically beneficial for the licensee to submit to an injunction in the UK, give up any UK profits, and hope to get a lower FRAND rate in that other jurisdiction. One driving force behind this analysis was the fact that the UK would be setting a worldwide rate and its effect would therefore be highly geared”.

According to Apple’s expert, under the IC model, “a potential licensee could beneficially exit the UK market” and this “would tend to move the licence rate away from any extreme set by the Court, towards something more “accurately” FRAND”.

One key feature of Apple’s argument was that the UK court’s FRAND rate might not be accurately FRAND, but something higher, and even worse that the UK Court might possibly something that was not FRAND. A second related point was that it would be highly unusual for a licensee in a voluntary FRAND licence to commit to terms before seeing them. The UK court expressed little sympathy for either of these arguments, noting in paragraphs 216 and 217 that:

“Of course it is the case that the Court might make an error. However, with all the procedural tools and support provided it ought to be unlikely. In addition, it is still more unlikely that the Court would make an error which actually takes the rate set outside the FRAND range. And there is the possibility of an appeal in the event of a serious error, especially an error of principle.

Furthermore, the making of an error by the Court is an aspect of litigation risk for which responsible parties can and do make allowances.”

On the second point, the UK court noted in paragraphs 229, 230 and 231 that

“Apple has been selling 4G products without Optis’ licence and will have to pay damages at least in the UK in due course; it does not know how much those will be and it will not have the opportunity to opt out of them, but it has taken on that uncertainty”, and

I do not think it is a point against Optis’ approach that it means implementers have to commit to unknown payments for SEPs. They do anyway, when they deal in standardised products without a licence. A fairer perspective is that the FRAND system reduces uncertainty by ensuring implementers that they can get a licence, and that the rate will be constrained to what is fair, reasonably and non-discriminatory.

I therefore hold that although unusual, committing to FRAND terms in advance is not especially onerous for implementers and that means are available to manage it”.

The UK Court also expressed sympathy for Optis’ arguments that the SEP holder is unfairly disadvantaged if an implementer such as Apple refused to commit to take a FRAND license. Speaking at paragraph 182, the court noted that “I find that delay is a real problem for SEP owners and is significantly asymmetric in its effects”. In paragraph 240, the consequences of delay for the SEP holder were enumerated and accepted by the court:

i) Delay does not prevent implementers from getting on with their businesses, since they have the standard and can use it, before they get a licence.

ii) By contrast, a licensing business may not run smoothly if there is significant delay.

iii) Delay hurts SEP owners because their SEPs have limited lifespans.

iv) Frequently when a licence agreement is made, the SEP owner has to discount the royalties/damages for past acts. I find that this is a significant and highly tangible result of delay. … In general having to discount is a real problem of delay.

v) If a SEP owner cannot get a licence from one implementer then other implementers will follow suit.

vi) Even when a SEP owner recovers damages after delay, the Court’s awards tend to undercompensate for the real loss, because of the cost of borrowing.

Thus, the court took the view that the economic evidence led to the conclusion that: “hold-out tends to damage SEP owners, and the effect of delay in particular is asymmetric, being worse for SEP owners than for implementers”, and “that the IC rule and Apple’s interpretation of clause 6.1 (they are very similar if not the same) would tend to create situations where implementers could practise hold-out that would harm SEP owners in their efforts to obtain financial rewards from their SEPs. The effects of delay tend to be asymmetric and affect SEP owners significantly more badly than implementers”.

Trial F – Conclusions

Based on the economic evidence, and an analysis of Clause 6.1 of ETSI’s IPR Policy, the court reached the view that “it is not right and not the intention of clause 6.1 for a party using the technology of a SEP to have the benefit of the patentee’s FRAND undertaking in terms of immunity from being sued, without the corresponding burden of taking a licence”.

However, the court rejected Optis’ argument that under ETSI Clause 6.1 an implementer that failed to commit to the licence at the relevant time would permanently lose the right to a FRAND license. First, the court was persuaded by the fact that at the time when the SEP owner first indicated its willingness, the implementer may not know then if it infringes at all, and that this would not be altered by the assumption that because an implementer is implementing the standard it must necessarily infringe some patents. The court did not accept that “it should be assumed that any SEP portfolio must have some valid and infringed patents in it. There may be small or weak portfolios which do not” (see paragraph 297).

Thus, the implementer did not lose its right to FRAND licence by failing to commit to a licence at the first of Optis two timing points (when the SEP holder commits to offering a FRAND license). However, the court did accept the relevance of the second timing point, “When there has been a finding of infringement of a valid patent the implementer can have a licence if it wants one, and it can carry on practising the relevant patent, but only if it intends to do so under a licence. In the procedure adopted in this Court, that will require the giving of an undertaking”. Optis’ argument about the second timing point was accepted in a modified sense, in that the court did not believe that ESTI Clause 6.1 required the commitment as such, but that the UK court was happy to maintain this requirement.

Based on a finding that delay is unfairly detrimental to the SEP holder, the Court concluded that “the implementer needs a licence when it is found to infringe, but on Apple’s analysis does not actually take one until later, and may never take one at all”.

Wider Background: The “ZTE v Huawei” and “Unwired Planet Supreme Court” decisions

This case is being decided against the background of the ZTE v Huawei decision of the CJEU [ii] and the Unwired Planet Supreme Court (“UPSC”) decision. In the ZTE v Huawei decision, the European court set out a number of steps that parties to SEP licence negotiations should follow.

In UPSC, these steps were found to provide a safe harbour for the SEP holder, such that a SEP holder following the guidance in ZTE v Huawei could not be found to be in abuse of a dominant position by seeking to assert their patent rights against an implementer. However, UPSC also found that the steps were not essential, and that when parties had not followed the guidance exactly, it would fall to the court to look at the behaviour of the parties more closely to determine whether there had been abuse.

In the UPSC decision, although the SEP holder had not made a FRAND offer at the beginning of negotiations, it had committed to providing a FRAND licence on terms determined by the court, and had therefore at all times shown itself to be a willing licensor. On the other hand, the defendant in UPSC, Huawei, had not made such a commitment, instead arguing that the only acceptable FRAND licence was the one that met its expectations of what a FRAND licence should be. Huawei had not therefore demonstrated it to be acting as a willing licensee. It was willing, but only on terms it considered acceptable. As a result, at the FRAND trial to determine relief, an injunction against Huawei was considered appropriate.

In the present case, Optis and Unwired Planet similarly agreed to be bound by the FRAND licence terms determined by the court. Similarly to Huawei, there was no agreement from Apple to be bound by the FRAND terms of the court in advance of seeing them, though ultimately Apple did give a conditional agreement to the court should this be required later.

In arguing against the need to accept a licence on FRAND terms, Apple had relies in particular on the fact that: “it has made a licence offer within the FRAND range (as I assume for the purposes of this trial). See paragraph 290. However, under the same paragraph, the judge noted that:

The trouble with the submission is that Apple only “wants” a licence and is only “willing” in a limited sense. Its offer within the FRAND range does put it in a different situation from that of Huawei in the Unwired litigation, but falls critically short of agreeing to take a licence on the point within the FRAND range that the Court settles at Trial E. It only “wants” a licence on its own terms and at a time of its own choosing, and then only conditionally; it reserves the right to say no altogether”

And in paragraph 289:

The way for Apple to remedy this situation as a matter of this Court’s procedure is to give an undertaking to take whatever licence is set at Trial E. That would ensure that its intention was to operate under a licence. One might debate at what point after it gave such an undertaking Apple would actually become licensed

Thus, in this trial, the court has decided that:

(1) Apple can only rely on Optis’ undertaking to ETSI if it (Apple) commits to enter into the FRAND licence determined at Trial E, and that Apple should be permitted a short time to consider whether it wishes to commit in that way, or offer some other undertaking.

(2) Apple’s allegations of abuse of a dominant position cannot prevent the grant of an injunction to restrain the infringement of Optis’ patent that [was] found at Trial B, and that Apple is liable to be injuncted from infringing the patent that [was] found valid and infringed in Trial B.

(3) The proper form of that injunction is a FRAND injunction and [the court] reject[s] Optis’ case that there should be an unqualified injunction.

Summary – What has changed?

In this decision, the UK court has determined that once infringement has been decided against one of the parties, the SEP holder has recourse to a FRAND injunction unless the infringing implementer gives an undertaking to accept the FRAND licence to later be determined by the court.

In reaching this conclusion, the UK court considered the detrimental position of the SEP caused by delay, concluding that it would not be fair to allow the implementer to wait until the FRAND trial (which may still be some months off) to decide whether or not to accept the courts’ terms. Doing so, would potentially allow an implementer to prolong negotiations with the SEP holder. The implementer could refuse the court determined FRAND licence and move to a “post rejection scenario” in which they would push for more favourable terms than those appointed by the court. Although it was recognised that there is not a single FRAND rate, and the lower terms may still be FRAND, the downward pressure on the rates agreed by the court was held to be unduly disadvantageous to the SEP holder.

Further, the implementer could if the UK market share was not a large part of its worldwide revenue choose to exit the UK market, and seek a worldwide licence in an alternative jurisdiction where it felt it might achieve better rates. The court noted that “In the period since UPSC there has not been a proliferation of courts actually setting global FRAND rates”, and that in the corresponding parallel proceedings in the US “global FRAND terms are not to be determined”.

The dispute between the parties is still ongoing, and there is considerable interest in seeing how Apple will respond. In the meantime, in pushing Apple to give an undertaking to accept the court appointed licence, the UK court has shown again that considers itself as possessed of authority to impose terms on the parties, if these terms apply a fair balance and if these terms will apply pressure on the parties to reach a realistic commercial settlement.

This article is for general information only. Its content is not a statement of the law on any subject and does not constitute advice. Please contact Reddie & Grose LLP for advice before taking any action in reliance on it.